Commentary on Darling's Guardian interview has largely (and rightly) focused on his view that the economic times faced are "arguably the worst they've been in 60 years". Faced, note: he's not talking about the current economic situation, he's talking about where it's going. The current difficulties don't look worse than the early 80s or the early 90s yet. But where is it going?

Commentary on Darling's Guardian interview has largely (and rightly) focused on his view that the economic times faced are "arguably the worst they've been in 60 years". Faced, note: he's not talking about the current economic situation, he's talking about where it's going. The current difficulties don't look worse than the early 80s or the early 90s yet. But where is it going?While it's often said that the first responsibility of a Chancellor is to talk the economy up, when everyone knows better it just sounds Panglossian and out of touch. So I think he's right this time, albeit for the wrong reasons.

It's not primarily about a credit crunch. Like the dot com bust before it, we're seeing the end of a bubble spun up by market players and governments to try and fend off something worse. Its symptoms are grim, sure, but the underlying problem is that we're well into the dying days of the cheap oil economy, more commonly known as globalisation.

Oil prices have dipped again, but as the FT says, this is just a lull in the storm. Colin Campbell and the good people at ASPO told us a long time ago what would happen, and so far it's all following their predictions.

As global oil output starts to plateau in 2007, they said, prices will spike. Given the total dependence of our economic model on cheap oil, we'll see a serious economic slowdown. This will lead to a drop in demand for oil, easing prices. Demand destruction, they call it. However, with maximum production matching supply so closely (i.e. in the absence of a swing producer), even small threats to production will cause significant price changes.

So far, so recognisable. We can expect the easing of prices below $100 again to lead to a small economic rally, and thus an increase in demand. My guess is that's probably not due before the spring, although I'm reluctant to make predictions.

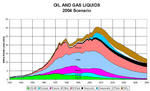

As demand then picks up, and as oil output starts to drop properly, probably 12-18 months from now (click on the chart above for a bigger version), we'll see another spike, almost certainly higher than the $147 peak seen in July, although that partly depends on the strength of the dollar. Cue even greater demand destruction.

No-one in government in London or Edinburgh, nor amongst their main oppositions, has any idea about how to cope with this. They're just hoping it'll all go away, and dammit, it won't. The timescales above may be out, but sooner or later it's coming.

Darling tells the story of a member of the public who said to him "I know it's to do with oil prices - but what are you going to do about it?". His response? "People think, well surely you can do something, you are responsible - so of course it reflects on me."

The man at the pump knows more about the problem than Darling, because he knows Darling can do something about it, a fact that seems to escape the Chancellor. Perhaps this random member of the public should do the job instead.

Of course Darling could do something about it: he could divert spending away from wasteful projects and wars and into renewables, R&D, public transport, etc. He could set an objective of energy independence. Any politician who doesn't tell you that getting off our fossil fuel addiction is their top priority doesn't deserve your vote.

The alternatives if we don't achieve that are likely to be dire. Coal's already back with a vengeance, and there's no dirtier fuel except old car tyres, so any idea that decreasing oil use will help climate change is a pure pipe-dream. The hard right and neo-Nazis may well start to do better as the economic situation worsens. They certainly think so: see point 4 on the top link here (that's a google link - I'm not directly linking to the bloody BNP's site!).

A lot of the goods and services we take for granted will become incredibly expensive, and fuel poverty will hit levels last seen when Good King Wenceslas famously looked out. Poverty as a whole will rise. I wouldn't bet against more resource wars, either.

There's no point worrying about it, though, when you can spend your time working to get more Greens elected instead.

Back to Darling's interview. His economic warning has understandably overshadowed his line that "This coming 12 months will be the most difficult 12 months the Labour party has had in a generation."

It's a pretty extreme prediction too, though. What, it'll be worse than the last 18 months where you lost every election going? Worse than a million people marching against a Labour-led imperial war? Worse, Darling, than any given part of 1978-1993?

How has it come to this, for Labour to have no imagination whatsoever about how to use a working Parliamentary majority? Here's a tip: why don't you address the looming energy crisis with something more constructive than nuclear and coal?

All Labour has left is angst about themselves, fear of being exiled into opposition, and fear of being shown up by the Tories. Their absence of vision is now absolute, and it does indeed sound as though Darling's had enough. Perhaps he, like his namesake from Blackadder Goes Forth, is about to go over the top.